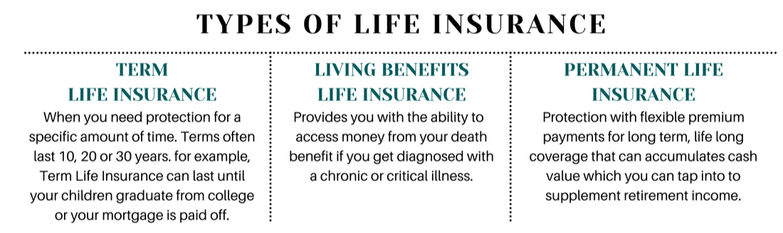

Flexible Coverage Options to meet Needs and Budget

Living benefits video

making a real difference

|

|

JOIN OUR FAMILY

Family is one of the most important, if not the most important thing in our lives. Here at LaBonte Insurance we strive to have high quality relationships with our clients.

We want to guide and educate you in making the best decision possible for your family to feel secure and protected. |

|

|

Peace of Mind that comes with Protecting your Family

|

No Medical Exam, Hassel Free Experience

|

|

DO I NEED LIFE INSURANCE?

Through every stage of life, there are ways to protect your family.

Whether you are a single individual, married couple, a newly empty nester getting ready to retire, or a business owner, making the right decision when it comes to your life insurance will give you peace of mind for the future. The birth of a child

Most people get life insurance to cover the mortgage, education, and other expenses so that their family can continue after they die. If you're planning to have a baby in the next year or so, now is a great time to buy life insurance. You work for yourself or have a

family owned buisness Consider Life Insurance to cover business affairs if one member of the family is key to the business. This individual could experience disability or death which can cause revenue streams to change. extreme hobbies

You may be a thrill seeker who enjoys sports that are higher risk such as sky diving, scuba diving or free hand rock climbing. Every insurance companies assesses the risk of hobbies differently. The premium may be higher, however your family is covered in the event there is an unnatural death. LEAVE AN INHERITANCE

You can set your kids up for a successful financial future and provide for monetary needs that may come up. Buying a Life Insurance policy and naming them as beneficiaries can create an inheritance plan. BRING PEACE OF MIND

Today, tomorrow or 60 years from now, eventually we will pass. No amount of money could ever replace a person. however, life insurance can help provide protection for the uncertainties life may throw at us. When you purchase Life Insurance, you no longer have to question whether your loved ones will be taken care of when you’re gone. This protects your family from the unknown and helps them through an otherwise difficult time of loss. Retirement planning

Mortgage protection

premium finance

If your clients are business owners, their net worth may not be liquid. Often, your clients may not want to liquidate growing assets to pay premiums. Premium financing can be a way for business owners to fund executive bonuses and buy-sell business continuation plans. life settlements

Usually 65 or older Refers to the sale of an existing insurance policy to a third party for a one-tome cash payment. The policy's purchaser becomes its beneficiary and assumes payment of its premiums, and receives the death benefit when the insured dies. |

|

MYTHS & MISCONCEPTIONS

There are multiple myths and misconceptions when it comes to life insurance. We can't control what you may read online or hear from others. However, we can help you dive into the facts and truth of life insurance.

You don't need life insurance if you're young and healthy

The best time to purchase life insurance is when you are at your healthiest. Medical problems can develop down the line resulting in higher rates or no coverage depending on conditions. life insurance is unaffordable

The majority of people overestimate the cost of life insurance. Life Insurance is very affordable, especially for younger and healthier people. Depending on the policy and specific needs they can offer the simplest coverage. life insurance from your job is sufficient

Many employers offer Life Insurance at little or no cost as part of employee benefits. However, this group insurance doesn't offer the coverage you may need. You also lose this coverage in the event you lose the position. Only the money-maker needs life insurance

Stay-at-home caregivers who don’t earn a salary often think they don’t need coverage. Services homemakers take on such as daycare, private chef, Housekeeper, Personal accountant are incredibly vital family services. Life Insurance can support those expenses your partner would need to replace that work by taking time away from their job or hiring help. i dont need life insurance, my kids are adults

Life Insurance later in life has a number of advantages. Choosing the right policy can help to relieve the burden of paying for final costs, paying for state estate taxes your heirs may face, paying off debt you may have left behind, or simply leaving your children with an inheritance. |

SCHEDULE AN APPOINTMENT

We have a variety of appointment options to choose from:

Zoom call, Phone Call, Email Correspondence, or In office Appointments

Zoom call, Phone Call, Email Correspondence, or In office Appointments

* For Agent Use Only